The crypto market is buzzing—even more so as Bitcoin reaches record highs—yet many altcoins, including Litecoin (LTC), are still resting at subdued levels. For those who approach the market with a strategic mindset, this is an unmissable opportunity to secure a strong position in Litecoin before the expected breakout. With careful planning and a solid understanding of Litecoin technical analysis for 2025, you can transform today’s market uncertainty into substantial financial gains.

This article presents a “set and forget” Litecoin trading strategy tailored for both beginners and professional traders. By focusing on clear entry levels, take-profit targets, and the reasoning behind this plan, you’ll gain the confidence needed to capitalize on Litecoin’s potential surge.

Why Litecoin Is Poised for a Comeback

Often dubbed the “silver to Bitcoin’s gold,” Litecoin holds a unique spot in the cryptocurrency landscape. While it has been overshadowed by newer and flashier altcoins, its strong foundations and track record make it a solid candidate for bullish runs, especially given the current market conditions.

Here’s why Litecoin deserves your attention right now:

1. Stagnant Prices Means Room to Spike

From $125.30 at the top to $56.25 at the bottom, Litecoin has been oscillating within a wide range. The ongoing consolidation hints at an accumulation phase—a technical stage where the asset is being quietly gathered before a significant rally.

2. Breakout Indicators

Key technical indicators, such as the RSI (Relative Strength Index) and stochastic RSI, are showing early signs of a reversal. While they haven’t fully confirmed upward momentum yet, experienced investors know that these conditions often precede major upward movements.

3. Bitcoin’s Pioneering Influence

Bitcoin’s all-time highs tend to act as a rising tide, lifting other boats in the cryptocurrency market. Litecoin, with its established reputation and strong community backing, remains well-positioned to benefit from this sentiment spillover.

If you’re ready to get ahead of the crowd, this “set and forget” trading plan will guide you in making the most of Litecoin’s potential for 2025.

The “Set and Forget” Litecoin Trading Strategy

Crypto trading can be stressful if you don’t have a well-defined plan, but this strategy removes the guesswork. By identifying optimal entry points and generous take-profit levels, this approach ensures you stay prepared for market opportunities without having to obsessively check the charts.

1. Mastering Litecoin Technical Analysis for 2025

Before making trades, it’s vital to understand Litecoin’s current technical landscape. Here’s a breakdown across key timeframes.

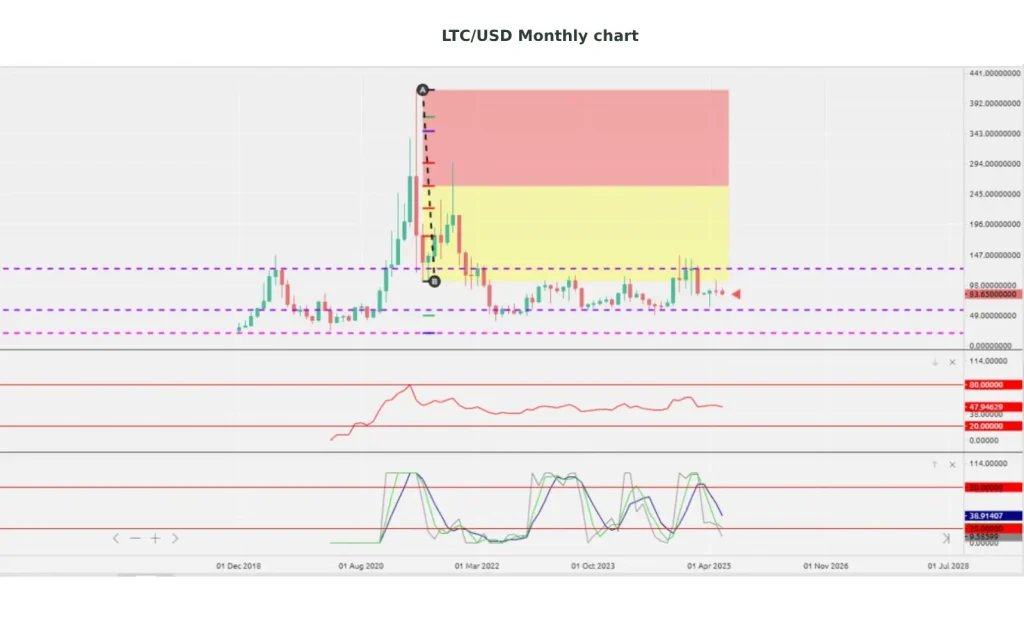

Monthly Outlook

- Range Boundaries: $125.30 (resistance) and $56.25 (support).

- Momentum Analysis: The stochastic RSI is approaching the buy zone, but the necessary green/blue line crossover for confirming bullish momentum hasn’t occurred yet. Further downside toward $56.25 remains possible.

Weekly Insights

- Current Level: LTC/USD is sitting near the $81.15 mark, resting on the 0.236 Fibonacci retracement level.

- Next Possible Targets: A drop to $62.75 (the 0.00 Fibonacci level) could occur before recovery begins.

- Indicators: The stochastic RSI points downward, nearing the buy zone. A crossover between the green and blue lines on this timeframe will signal a turning point.

Daily Chart Snapshot

- Current Consolidation Zone: Litecoin is ranging between $92.93 (0.500 Fibonacci) and $83.00 (0.000 Fibonacci).

- Moving Averages: Short-term momentum is bullish as stochastic RSI has moved into the buy zone with green/blue crossover confirmation. A bounce toward $92.93 is likely.

2. Laddered Entry Points for Maximum Value

To capitalize on Litecoin’s favorable risk-reward scenario, this strategy employs a laddered entry method. By spreading your trades across staggered levels, you can ensure you’re buying at optimal prices—even if the market surprises you.

- Entry 1 (NOW)

Buy a small portion of Litecoin at $81.15, the current price level.

- Entry 2

Place a buy order at $78.56, aligning with the 1.618 Fibonacci level as identified on the 4-hour chart.

- Entry 3

Set another order at $62.75, coinciding with the 0.00 Fibonacci level from the weekly timeframe.

- Entry 4 (Extreme Case)

Finally, prepare for the possibility of Litecoin hitting $56.25, the bottom of the long-term monthly range, which historically represents a strong support zone.

Pro Tip: Divide your total investment into four equal parts, allocating an equal amount to each level. If you’re investing $1,000, place $250 at each entry point.

3. Generous and Strategic Take-Profit (TP) Levels

Unlike traditional setups, this strategy focuses solely on generous take-profit levels without stop losses, allowing you to ride the notorious volatility of crypto markets.

- TP1 (Short-Term): $92.93

The upper boundary of the daily range; this marks a good first milestone to secure some profits.

- TP2 (Mid-Term): $125.30

A high-probability target at the top edge of the monthly range.

- TP3 (Strategic): $150.00

A psychological resistance level; breaking past $125 could drive momentum to this point.

- TP4 (Bullish Breakout): $200.00

Litecoin has reached levels like this in the past during bullish phases. It’s an ambitious yet achievable target for long-term holders.

Pro Tip: Experienced traders may want to scale out gradually, taking partial profits at each TP level and holding a portion of the position for higher targets.

###

Special Thanks:

A huge shoutout to our senior analyst, Jackie, for her brilliant Fibonacci analysis of Litecoin. Her insights are so sharp, they could probably cut through military-grade armor! Seniors and veterans, take note—Jackie’s strategies are as reliable as a well-drilled platoon. 🎖️